Government’s drastic measures to raise tax revenue are crucial for expanding basic infrastructure and services and ensuring social justice, according to economists.

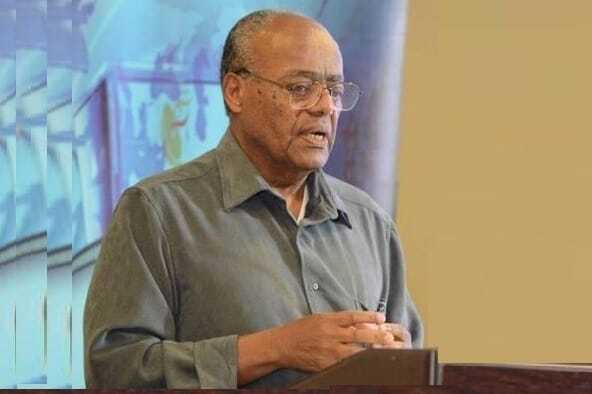

Economist Costantinos Beruhtesfa (PhD) told the Ethiopian Press Agency (EPA) that the government is implementing actions to improve the tax system and increase revenue options. Compared to other African countries like Kenya, South Africa, Tunisia, and Morocco, Ethiopia’s tax revenue is low. However, Ethiopia is making exemplary progress in advancing the tax system and increasing revenue from excise taxes.

Proper tax collection helps increase government income, which can be used to implement laws and plans that improve livelihoods, expand public services, and promote culture and justice. To this end, Costantinos emphasized the importance of raising public awareness about the benefits of paying taxes.

A property tax enables the government to collect necessary tax income from citizen-owned properties. Strengthening measures related to this law is essential for improving income and reducing poverty through ensuring social justice. Costantinos also suggested that the government reduce and eventually stop subsidies to regional states to strengthen tax collection at the state level.

Another economist Hailemeskel Gazu suggested improving the tax collection process by monitoring tax auditors. He pointed out that some tax collectors engage in corruption instead of enhancing tax revenue. “Those involved in corruption must be held accountable and corrected to bring about attitudinal change.”

Hailemeskel recommended applying a digital system and forming a group to verify tax auditors’ reports, which could help the government gain an additional 10 percent income from current tax revenues. Doubling the current tax revenue is necessary to ensure national growth through the construction of vital projects.

Hailemeskel also called on revenue-collecting institutions to control tax fraud and evasion through advanced, technology-supported tax collection mechanisms. However, he acknowledged that current property tax laws aimed at increasing revenue are affecting low-income citizens. Amending the new law is crucial to mitigate its impact on citizens while still expanding tax options.