Malawi’s total economy foreign exchange reserves improved in April this year from $545.7 million (2.2 months of imports) in March to $595.2 million (2.4 months of imports), a latest Monthly Economic Review by the Reserve Bank of Malawi (RBM) has shown.

The reserves were also even better as compared to the $594.4 million (2.4 months of imports) recorded at the end of April 2023.

The April 2024 Monthly Economic Review says the rise in the total foreign exchange reserves was attributed to increases in both the gross official reserves and private sector reserves.

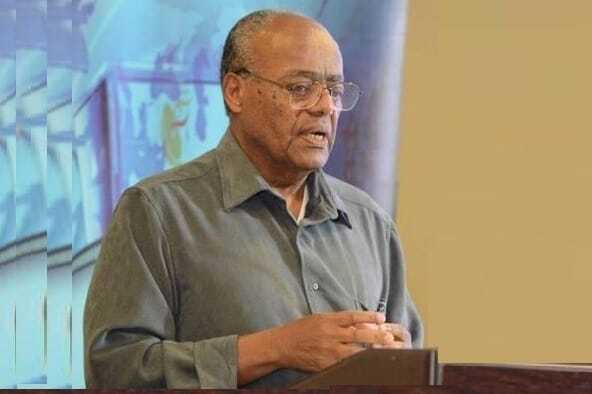

In an interview Thursday, RBM spokesperson Mark Lungu said it is pleasing to see both official foreign exchange reserves and those managed by the private sector improving.

“This is positive for the economy as we need the foreign exchange to facilitate importation of essential commodities.

“In addition, an improved foreign currency reserves position is crucial for us as this helps to stabilise the movement in the local currency and this has a positive bearing on inflation,” Lungu said.

He added that RBM expects the build-up to continue as Malawi is still in the marketing season of tobacco and other cash crops.

As at the end of last week, which was the eighth week of tobacco sales, the country had realised $218.7 million from sales of the green gold.

Figures from AHL Tobacco Sales showed that as at the end of eight weeks of sales, a total of 76.9 kilogrammes of all tobacco types had been sold at an average price of 2.85/kg.

This is compared to the same time last year, when 61.4 million kilogrammes of all tobacco types were traded at an average price of $2.26/kg, from which the country earned $138.7 million.

According to the report, in April 2024, the Malawi Kwacha appreciated against most currencies of the country’s major trading partners, except against the South African rand.

In particular, the report says, the Kwacha gained value by 0.3 percent against the United States (US) dollar and traded at K1,745.70 per dollar at the end of April 2024.

“The US dollar somewhat weakened due to negative investor sentiment on dollar-denominated equity and bond asset classes with an expectation of increasing yields.

“Likewise, the local currency strengthened by 1.4 percent and 0.5 percent against the euro and the British pound, respectively, to close the review month at K1,922.25 per euro and K2.256.81 per pound. The euro and pound both slipped due to market expectations of favourable yields in the US compared to the Euro area and the United Kingdom,” the report says.

Furthermore, the report says, in the Asian region, the Kwacha appreciated by 3.5 percent against the Japanese yen and traded at K11.06 per yen at the end of the month of April 2024.

It says, despite interventions from the Bank of Japan, the yen still weakened driven by a wide US-Japan yield divergence.

“Similarly, the Malawi Kwacha strengthened by 0.2 percent against both the Chinese yuan and Indian rupee and closed the review month at K239.37 per yuan and K20.76 per rupee. Both currencies lost ground owing to capital outflows amid rising global geopolitical risks.

“Within Sadc, the Kwacha depreciated by 0.8 percent against the South African rand and traded at K95.40 per rand as at end-April 2024. The rand gained on account of improved investor demand as evidenced by a bullish stock market in the review month.

“However, against the Zambian Kwacha, the local currency appreciated by 6.0 percent and traded at K65.18 per Zambian Kwacha. The Zambian Kwacha lost ground due to a relatively high demand for foreign exchange amid low supply,” the report says.