The National Bank of Ethiopia (NBE), the Mastercard Foundation, and First Consult, through the BRIDGES programme, announced the National Financial Education Module for Youth and Micro, Small, and Medium Enterprises (MSMEs) in Addis Ababa on 29 February 2024. The official opening event of the Standardized National Financial Education Module for youth and MSMEs was held in the attendance of key stakeholders in the Ethiopian financial industry- including Martha Hailemariam, Advisor to the Vice Governor of the National Bank of Ethiopia, Samuel Yalew, Country Director for the Mastercard Foundation in Ethiopia, Nebil Kellow, Managing Director for First Consult, and CEOs of all banks and microfinance institutions. The preparation of the module promotes financial literacy and empowers individuals to make informed financial decisions, thereby fostering financial inclusion and creating a stronger economy. At the event, the National Financial Education Module was handed over to the National Bank of Ethiopia.

In her keynote speech, Martha Hailemariam, Advisor to the Vice Governor of Financial Institutions Supervision at NBE, emphasized that this module will play a pivotal role in advancing financial literacy, with the goal of achieving a 75 percent awareness level of financial services among MSMEs by 2025. Highlighting NBE’s commitment to enhancing financial inclusion and ensuring sector stability, the advisor underscored the importance of coordinated efforts in promoting financial capability and awareness. The comprehensive module covers various topics, including savings, digital banking, lending, insurance, interest-free finance, and business planning, with a special focus on supporting women entrepreneurs.

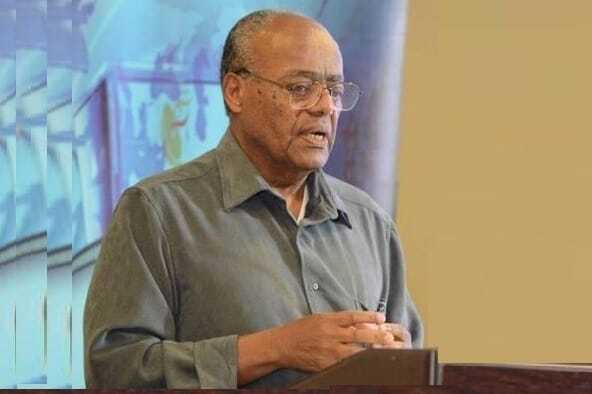

Samuel Yalew, Country Director for the Mastercard Foundation in Ethiopia, noted that the announcement of the National Financial Education Program for Youth and MSMEs is a pivotal step in realizing the goals outlined in the National Financial Education Strategy. By targeting young people and MSMEs, Samuel stressed the potential to address critical gaps and foster job creation and economic growth in Ethiopia.

Nebil Kellow, Managing Director of First Consult, highlighted the significant challenges facing young people and MSMEs in achieving financial inclusion, notably the lack of awareness and literacy. He emphasized that financial education plays a vital role in equipping individuals with the necessary knowledge, skills, and confidence to navigate the complexities of the financial landscape and achieve their financial goals.

The development of the Financial Education module is considered a significant milestone in the efforts to enhance financial literacy. It provides a comprehensive framework that financial institutions can utilize to design and implement effective financial education programs for their customers and benefit millions in the coming months and years. Financial education equips young people and MSMEs with the necessary knowledge and skills to navigate the complex financial landscape. It empowers individuals to make informed financial decisions, leading to improved financial well-being and economic stability.

BRIDGES is a five-year program (2019-24) aiming to create and support 718,000 youth jobs, mostly for women. It’s implemented by First Consult in partnership with the Mastercard Foundation. It focuses on the manufacturing sector, covering all regions and city administrations to address unemployment in Ethiopia. BRIDGES supports both self- and wage-employment, targeting unemployed youth and enterprises, to provide them with demand-based skilling, information, mindset training, linkage, capacity building, and access to finance. BRIDGES delivers this support in collaboration with its enabling partners, including public and private organizations.