Addis Abeba – The Ethiopian government conveyed its readiness to discuss possible mitigants with its bondholders, who are engaged over how long to extend the maturity and spread out repayments of its single $1 billion international bond maturing in December 2024.

In a statement issued today by the Ministry of Finance, proposed mitigants include a loss reinstatement provision. This provision aims to effectively return bondholders to their previous position if Ethiopia needs to renegotiate the agreement terms within the next two years, ensuring comparability of treatment.

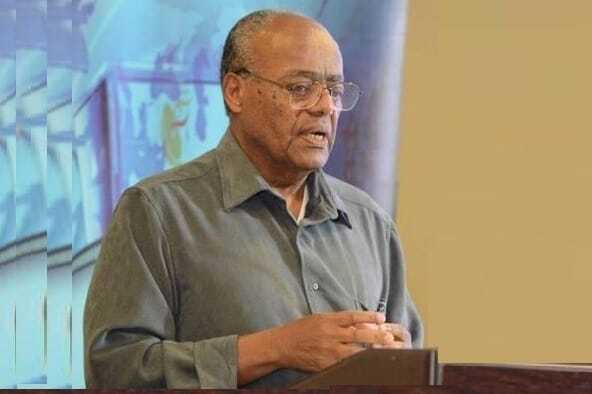

Yesterday, the Ministry of Finance in Ethiopia hosted a global investor call to provide an update on the country’s engagement with external creditors regarding debt treatment. State Minister of Finance Eyob Tekalign led the one-hour session, which attracted more than 100 participants.

During the call, he outlined Ethiopia’s strategy for securing support from Eurobond holders in preparation for negotiations under the Common Framework for debt treatment.

Ethiopia is currently negotiating debt service suspension with its official bilateral creditors under the G20 Common Framework for debt treatments. Recently, Ethiopia’s bilateral creditors agreed to suspend debt payments until 2025. However, this suspension could be nullified if the country does not secure an International Monetary Fund (IMF) loan by 31 March, 2024.

According to the statement, the Ministry of Finance is currently working towards consistency and fairness by seeking comparable arrangements from other external lenders, including Eurobond holders.

In its statement, the government clarified that Ethiopia’s decision to suspend its December coupon payment on outstanding Eurobonds, despite the relatively small amount, aims to treat all creditors equally. “Failing to do so could jeopardize ongoing discussions with other lenders,” said the ministry.

The government has invited bondholders to consider contributing early, possibly as a one-time measure, to address its debt issues. This approach would enable Ethiopia to maintain reduced coupon payments during broader negotiations under the G20 Common Framework.

The parameters, crafted to minimize the risk of revisiting the agreement within the Common Framework, aim to balance stakeholder interests, according to the government. The goal is to seek as few concessions from bondholders as reasonably possible given the circumstances.

Bondholders who engaged with the Ministry of Finance during a Q&A session yesterday are encouraged to submit additional questions and provide feedback on the outlined Eurobond restructuring proposal via email. AS