For Japhter Nyathi, whose 5-hectare plot at Honeybird Kop Farm, Umguza district in Matebeleland North was destroyed by a hailstorm a few weeks before expecting his first 2022 harvest, insurance was the least of worries until tragedy struck.

The hailstorm hit the farm which houses 20 smallholder beneficiaries, who practice both cattle rearing and crop cultivation.

Nyathi (61) suffered a painful loss.

“The hailstorm started on Sunday between 4 and 5pm. For the first five minutes, it descended on the plants and destroyed my crops. I have 4.5 hectares of maize, one hectare of sorghum, another of sugar beans and various crops that include melons and pumpkins. The majority was destroyed by this hailstorm,” Nyathi was quoted by Sunday News then.

But Nyathi is not alone as most areas in Zimbabwe regularly experience hailstorms leaving many farmers at a loss.

Tobacco, the country’s major foreign currency earner, has also not been spared the vagaries of inclement weather.

The industry regulatory, Tobacco Industry Marketing Board (TIMB) raised concern over lower yields and compromised quality from last year’s harvest.

Taking note of the recurrence of hailstorms, floods, droughts and other weather-induced uncertainties affecting crops and diseases afflicting livestock, developing agriculture insurance to protect smallholder farmers in Zimbabwe cannot be over-emphasised.

To this end, International Finance Corporation (IFC) and Zimbabwe’s insurance regulator, the Insurance and Pensions Commission (IPEC) collaborated to create a market for agricultural insurance products whose goal is to protect smallholder farmers against weather-related crop damage and other shocks.

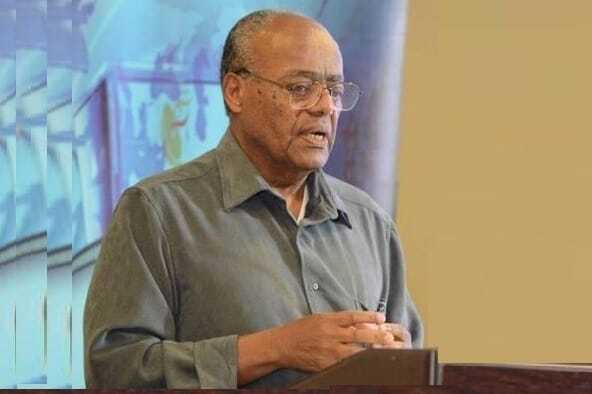

IPEC Director, Insurance and Micro-Insurance, Sibongile Siwela told journalists undergoing a Journalism Mentorship Programme (JMP) that there was aggregate demand for agriculture index-based insurance.

“There is a lot of interest from stakeholders in this area, which involves insurers who are very keen to roll out this type of insurance.

“The farmer organisations who represent farmers are also keen to try this type of insurance. So we have seen a lot of enthusiasm in this area,” said Siwela.

The IFC team will help IPEC develop a regulatory framework and enabling environment for agricultural insurance and determine the features of insurance products appropriate for Zimbabwe’s farmers.

Added Siwela, “We are currently working on a framework to guide the industry on this type of insurance. But there are insurers that are doing something about it, they are offering this product and it has takers but not in a structured manner that we would want.

“So, there is need, the interest is there and stakeholders are all willing to participate. We are really looking forward to growth of this type of insurance,” the IPEC director said.

Well-designed insurance programmes can help improve farmers’ resilience, access to finance, and high-quality inputs.

Through this project, the team will assess risks faced by smallholder farmers, their coping mechanisms, and also evaluate the farmers’ appetite for agricultural insurance to protect livelihoods.