Nairobi — President William Ruto expects dollar demand in the country to ease as the government plans to import fuel in Kenya shillings.

Ruto’s remark comes after the cost of buying a dollar increased to as high as Sh145.5 per dollar as of yesterday.

Greenback demand in the country has been rising over the last few years due to high demand from importers.

However, dollar requests are expected to drop after the Kenyan government and its Saudi counterpart signed an import deal for fuel importation on credit.

Early this month, Energy Cabinet Secretary Davis Chirchir said that the oil import deal would see the state-run National Oil Corporation (NOCK) import 30 percent of the country’s monthly fuel requirement.

The above will be on credit for six months to a year, helping the government ease pressure on the dollar.

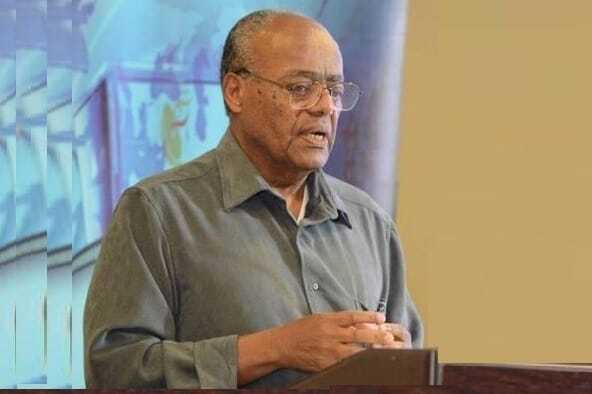

“And So I just want to assure those in Kenya who were facing challenges of access to dollars that we have taken steps to ensure that dollar availability in the next couple of weeks is going to be very different because our fuel companies will now be paying for fuels in Kenya shilling,” the President said during the listing of the Laptrust Imara I-REIT at the Nairobi Securities Exchange today.

“They do not to look for dollars every month because we have done what we must do as a government to ensure that we ease the burden on people who want to realize their returns in dollars,” he added.

The latest Central Bank of Kenya (CBK) weekly bulletin shows that the country’s usable foreign exchange reserves stood at USD 6.56 billion (Sh852.2 billion) as of March 9, equivalent to 3.67 months of import cover.

Kenya imports the vast majority of its fuel from countries such as Saudi Arabia and the United Arab Emirates, among others, and pays in dollars.

Signs of dollar demand easing could be seen today, with the cost of buying one dollar dropping to about Sh140 from Sh145.5 yesterday.

“I am giving you free advice that those of you who are hoarding dollars you shortly might go to losses you better do what you must do because this market is going to be different in a couple of weeks,” he added.